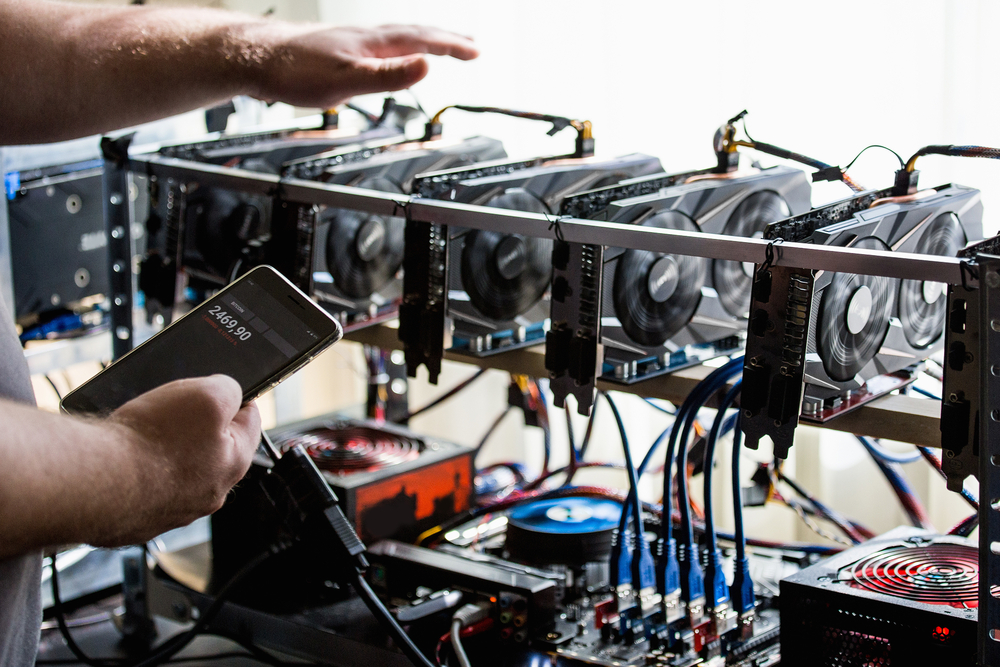

Chinese Crypto Miners Expects Number Of Crypto Buyers To Rise

Known Chinese crypto miners expect an influx of new buyers six months after halving. RockX, a crypto services firm, released a survey report on May 4 that claimed that 57 percent of Chinese crypto miners expect a large number of new Bitcoin purchases to join the market.

The survey was conducted on 42 Bitcoin miners and Asian mining community members, including operating officer Yu Chao, TokenInsight partner Wayne Zhao, Pandaminer, and OXBTC CEO Wilson Guo, as well as, Bitmain APAC head of sales Fan Xiaojun.

More than 71 percent of the respondents think that the market regained its confidence in the cryptocurrency. The survey also concluded that 45 percent of the miners believe that Bitcoin’s price will trade between $10,000 and $12,000 in the next six months. It was also found that bitcoin will remain around $10,000 with low volatility, while the 14 percent think that Bitcoin will reach the trade value of $15,000.

Miners are optimistic on profit

The majority of the respondents believe that the cryptocurrency’s hash rate won’t change significantly after the halving. The miners also expect the exhashes between 110 and 130 every day. BitOnfoCharts, a Bitcoin network website, reported that B Bitcoin’s network currently has a hash rate of 127 exahashes per day.

Alex Lam, RockX CEO and a long-time manager of mining firms since 2013, said during an interview with a cryptocurrency news outlet that domestic mining farms could take advantage of cheap hydropower and continue operating with older and less efficient machines because of the wet season in the country.

Mining farm status

The CEO explained that mining farms based in the US, Canada, and Europe might get rid of their old mining machines after the halving. He predicted that the hash rate of the cryptocurrency would fall by not less than 30 percent one month after the halving.

The miners also predicted that the US economy would impact Bitcoin’s influence as time goes by. The majority of the respondents expect Federal Reserve’s quantitative easing measures to have a positive effect on the cryptocurrency.

Some of the respondents, 12 percent, think that the measures will have a very positive impact, while the other 12 percent believe that there shall be no impact.

Chinese miners expect good business as spring comes since they can enjoy cheap electricity due to excess in hydropower. Water-abundant parts of China offer a low price for the power to attract investors like bitcoin mining firms. Huang Fangyu, the co-founder of Valar Hash, said that if bitcoin’s price doesn’t go up post-halving, nobody will buy new equipment to fulfill the capacity.

Valar Hash is behind the mining 1THash, a company that owns facilities used in self-mining in Sichuan. Recently, CoinShares, a research firm, reported that China contributes 65 percent of Bitcoin’s global computing power.

Read Also:

Bitcoin Crosses $10,000 Mark, Then Tumbles Back Down Again

Bitcoin recently made quite a rally after hitting the $10,000 in the market, only to…

As Coronavirus Pandemic Surges, So Does Cryptocurrency Wallet BRD’s downloads

With more than half of the world in lockdown due to the coronavirus pandemic, people…

Supercomputer Hacking Frequents in Europe Due to Crypto Mining

Several supercomputers were infected with cryptocurrency mining malware across Europe this week. The infected supercomputers…

Industry Experts Warn About Russia’s Crypto Iron Curtain

Russia’s cryptocurrency industry is fighting against a number of legislations that will it difficult for…

The Future of Healthcare is Blockchain

With majority of the world reeling to the effects of the coronavirus pandemic, tech and…

Bank of Russia Mortgage Issuance May Soon Adopt Blockchain Technology

Blockchain technology is widely praised for its security and redundancy features. Because of this, the…