Third Bitcoin Halving Takes Place on Monday

Bitcoin is the most popular among the cryptocurrencies. The popular cryptocurrencies has undergone adjustment on Monday. The adjustment reduced the rate of new coins creation.

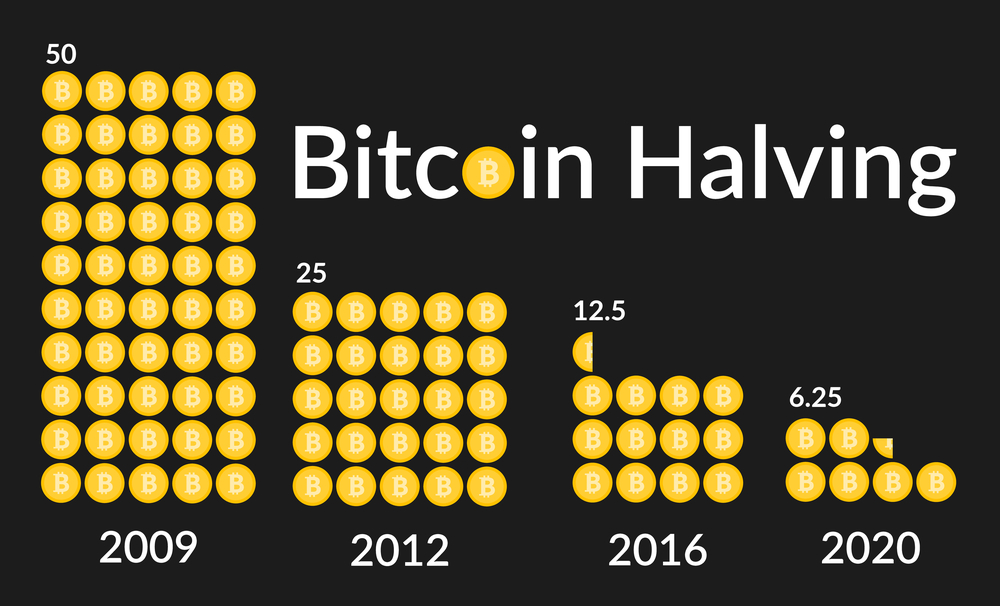

The process of reducing the bitcoin rate is called halving. The halving of bitcoin occurs exactly every four years. As the outcome of the halving event, bitcoin fell into volatile trading. It also vaguely lost in value against the US dollar.

Bitstamp is a bitcoin exchange trading platform that is based in Luxembourg. On the trading platform, bitcoin dropped 1.3% at $8,620.43 in the late afternoon trading in the same day.

Significance of Bitcoin’s Miners

The leading cryptocurrency relies on miners. Miners are the ones who run software that solves favorably complex math puzzles in return for bitcoins. The halving event on Monday reduced the reward for unblocking a block. The reward block dropped from 12.5 to 6.25 new coins.

Bitcoin’s creator introduced the halving process of the popular cryptocurrency into the cryptocurrency’s code. Satoshi Nakamoto is the creator of the famous bitcoin. Nakamoto introduced the halving process of bitcoin in order to control inflation.

The first bitcoin halving event took place in November 2012. The second halving event transpired in July 2016. As stated by GadgetsNow, the next halving is set to happen in May 2024.

As said by CoindDesk, the digital currency’s code will continue to halve every 210,000 blocks. The purpose of this continuation is to limit the total number of bitcoins that will ever exist to 21 million.

At this rate, it is foreseen that the blocks will arrive at zero within two decades. The course of action to control the inflations is crucial. This is indeed necessary because supply of cryptocurrencies ae not regulated by banks.

Supporters of bitcoin regard this scarcity as a part of its value that makes it as a prospected safeguard. Especially during the times of economic crisis. This is compared to other currencies vulnerable to devaluation.

Since the beginning of this year, bitcoin has gained over 20%. It even touched $10,000 last week. Currently, bitcoin price is around $8,600.

Bitcoin as a Safe Haven during Crisis

A hedge fund manager, Paul Tudor Jones made a statement that supports the digital currency. According to Jones, bitcoin is a safe haven against inflation. This statement of Jones brought the recent gains of the cryptocurrency.

On the contrary, other bitcoin investors voiced out their concerns about halving. These investors said that halving could make bitcoin less attractive.

No single bitcoin mining entity functions as a central bookkeeper. The mining rewards represents the economic incentive for miners. Miners are the ones who contribute their computing power in processing transactions on the network. Miner’s computing power also secure the bitcoin network.

The direct implication on the mining rewards of 2020 halving is the newly minted bitcoin a day. Formerly, there was 1,800 units but it fell to 900 units after the halving event.

Read Also:

Bitcoin Crosses $10,000 Mark, Then Tumbles Back Down Again

Bitcoin recently made quite a rally after hitting the $10,000 in the market, only to…

As Coronavirus Pandemic Surges, So Does Cryptocurrency Wallet BRD’s downloads

With more than half of the world in lockdown due to the coronavirus pandemic, people…

Supercomputer Hacking Frequents in Europe Due to Crypto Mining

Several supercomputers were infected with cryptocurrency mining malware across Europe this week. The infected supercomputers…

Industry Experts Warn About Russia’s Crypto Iron Curtain

Russia’s cryptocurrency industry is fighting against a number of legislations that will it difficult for…

The Future of Healthcare is Blockchain

With majority of the world reeling to the effects of the coronavirus pandemic, tech and…

Bank of Russia Mortgage Issuance May Soon Adopt Blockchain Technology

Blockchain technology is widely praised for its security and redundancy features. Because of this, the…